News

24.09.2021 PGNiG to acquire 21 licences on the Norwegian Continental Shelf

PGNiG Upstream Norway has just received approval from Norwegian authorities to acquire all assets of INEOS E&P Norge. Once the transaction is completed, the PGNiG Group will acquire a portfolio of promising upstream assets, set to meaningfully contribute to the delivery of its strategic objectives in natural gas production.

The Norwegian authorities have given a green light to the acquisition by PGNiG Upstream Norway of all INEOS E&P Norge assets, including interests in 21 licences. As a result, the company may now consummate the agreement concluded with the INEOS Group in March 2021. The estimated payment upon completion of the transaction will be approx. USD 323 million (approx. PLN 1.27bn) versus initially agreed USD 615m for the contractual transaction date of January 1st 2021. The difference is attributable to the reduction of the initially agreed price by income generated by INEOS E&P Norge over the first nine months of the year.

‘The transaction terms are very favourable, demonstrating PGNiG's competence in E&P sector deals. The purchase of INEOS E&P Norge’s licences will allow us to achieve one of our strategic objectives related to security and diversification of gas supplies, while being an investment in promising and highly profitable assets,’ said Paweł Majewski, President of the PGNiG SA Management Board. The company is the sole owner of PGNiG Upstream Norway.

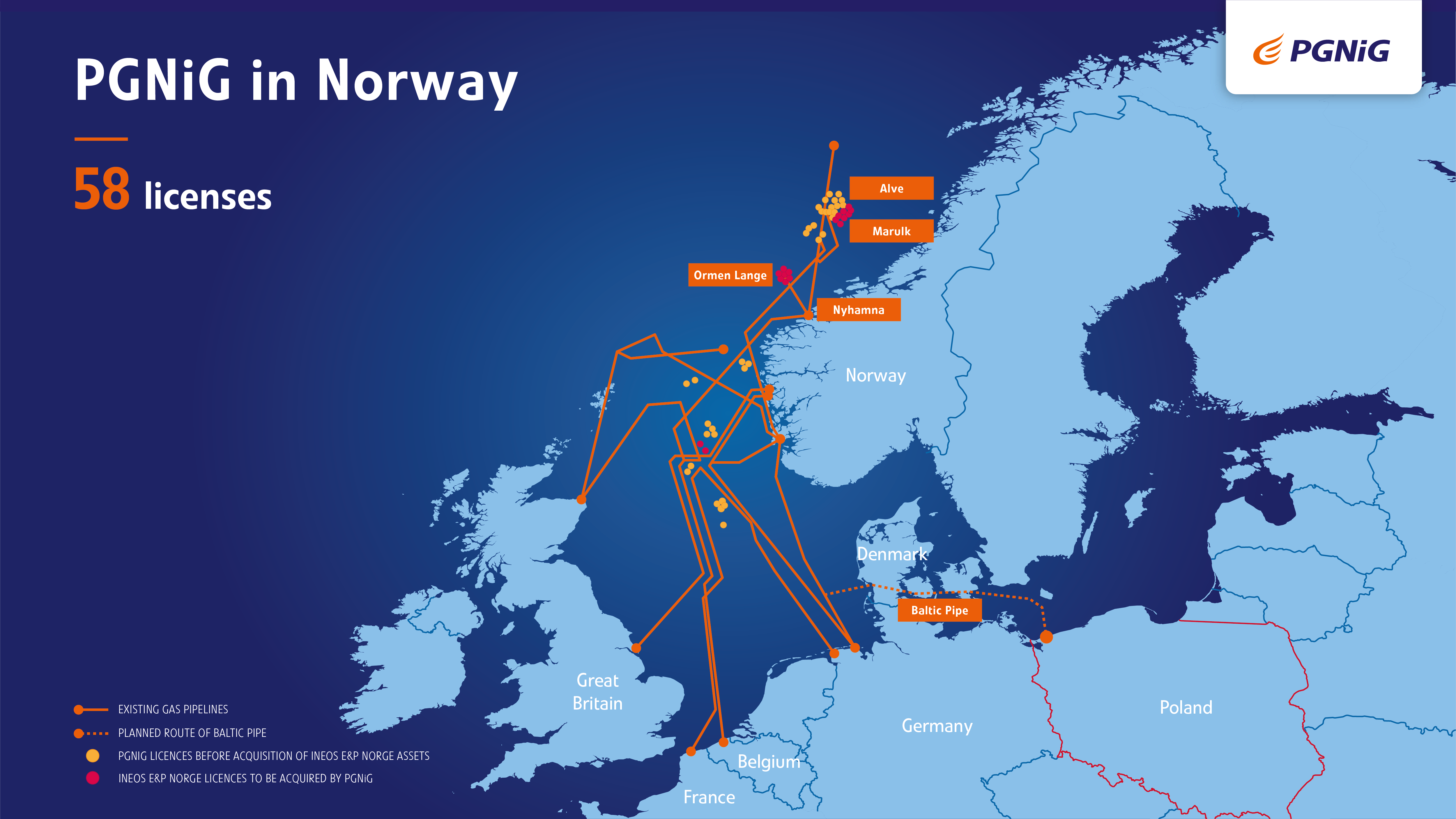

The purchased licences include producing fields: Ormen Lange (14%) Marulk (30%) and Alve (15%). The key asset is Ormen Lange, the second largest gas field on the Norwegian Continental Shelf. As part of the transation, PGNiG Upstream Norway will also acquire an 8.2% interest in the Nyhamna gas processing plant (8.2%), which receives the output of Ormen Lange and Aasta Hansteen, among other fields.

The transaction will significantly increase hydrocarbon reserves allocated to PGNiG Upstream Norway to 331 mboe (as of 1.1.2021). The company will also increase its annual gas production by approximately 1.5 bcm. Taking into account the projected production volumes from the previously acquired licences, next year the PGNiG Group’s output of natural gas from the Norwegian Continental Shelf will reach approximately 2.5 bcm. This means that the target set in the Group’s Strategy for 2017–2022 will be met.

Once the Baltic Pipe becomes operational, gas produced by PGNiG Upstream Norway will be transported to Poland, enhancing gas supply diversification and strengthening the country’s energy security.