News

08.11.2021 PGNiG submits Plan for Development and Operation of the Tommeliten Alpha field

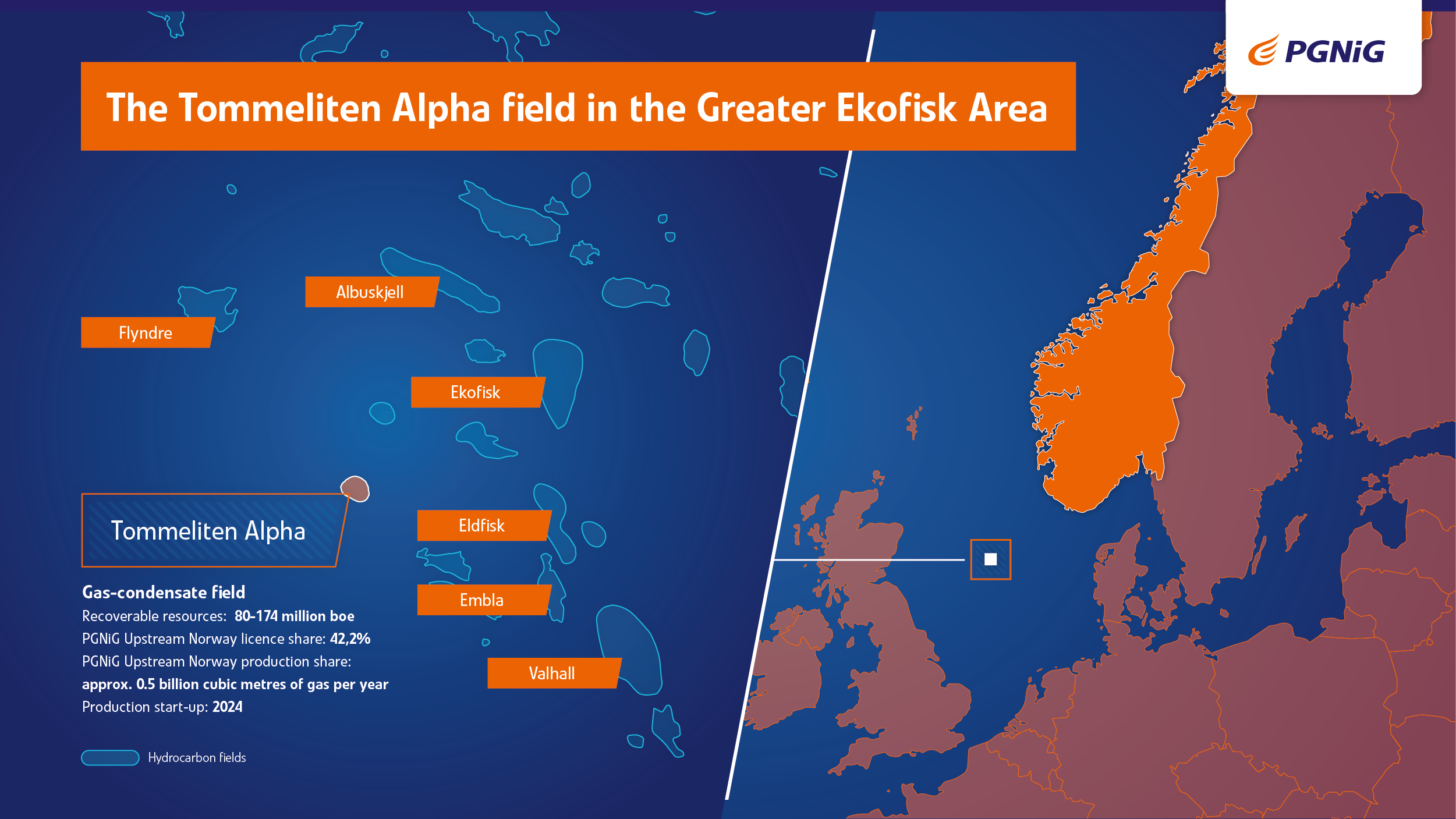

PGNiG Upstream Norway, together with its licence partners, has applied for approval of plan for development and operation of the Tommeliten Alpha field in the North Sea. The production start-up is scheduled for 2024. In the peak period Tommeliten Alpha should increase company’s hydrocarbon output by 0.5 billion cubic meters of natural gas per year.

“We are confident that together with our partners, we have developed an optimal development plan that will fully unlock the potential of this highly prospective area. The commencement of production from the Tommeliten Alpha field will translate into a substantial increase in gas production by the PGNiG Group on the Norwegian Continental Shelf. This will significantly facilitate the realisation of our strategic goals related to the diversification of gas supplies to Poland as well as international development of our E&P activity," said Paweł Majewski, President of the Management Board of PGNiG SA, the company which is the sole owner of PGNiG Upstream Norway.

The plan for development and operation (PDO) of the Tommeliten Alpha assumes drilling ten production wells, which will be connected via heated flowline to the infrastructure of the Ekofisk complex. The first two wells will start production in the first half of 2024. The ability to use the highly developed infrastructure of Ekofisk area will significantly reduce development costs.

As the Tommeliten Alpha is located in the Norwegian and British sectors of the North Sea, the PDO is the subject to administrative approvals by the Norwegian Ministry of Petroleum and Energy and the UK Oil and Gas Authority.

The Tommeliten Alpha is a gas-condensate field whose recoverable resources, consisting mainly of gas condensate, have been estimated at 80-174 million barrels of oil equivalent, of which PGNiG’s share is 33-73 mmboe. The production volume for PGNiG will be approx. 0.5 billion cubic metres of gas per year in the peak period.

PGNiG Upstream Norway owns a 42.2% share in the licence covering the Tommeliten Alpha field, which it bought from Equinor in a transaction concluded in October 2018. The other partners are ConocoPhillips Skandinavia (28.14% share, licence operator), TotalEnergies EP Norge (20.14%), Vår Energi (9.09%), ConocoPhillips (U.K.) Holdings (0.21%), Total Energies UK (0.15%) and Eni UK (0.07%).

The Tommeliten Alpha will be tied back to Ekofisk complex, which is one of the most important hubs for hydrocarbon production in the North Sea. Ekofisk itself is the first oil field discovered in the North Sea, which took place in 1969. Production from the field, launched in 1971, is planned until 2050.

As a result of the acquisition of all assets of INEOS E&P Norge, from October 1st PGNiG Upstream Norway increased the number of licences in its portfolio from 37 to 58. That includes 14% of Ormen Lange – the second largest gas field on the Norwegian Continental Shelf with an expected production life beyond 2045. The producing assets of PGNiG Usptream Norway consist of 14 fields. The company estimates that it will increase production of natural gas to above 2.5 bcm in 2022 compared to approx. 0.9 billion cubic meters this year. This will be a result of launching production from new fields and additional wells in addition to acquisitions of interests in already producing fields.